The European Patent Office (“EPO”) and the European Intellectual Property Office (“EUIPO”) recently released a joint report titled “Patents, Trademarks and Startup Finance: Funding and exit performance of European startups” (the “Report”).

The European Patent Office (“EPO”) and the European Intellectual Property Office (“EUIPO”) recently released a joint report titled “Patents, Trademarks and Startup Finance: Funding and exit performance of European startups” (the “Report”).

The Report contains valuable data and analysis drawn from a study of the European startup market and the role of intellectual property rights—specifically patents and trademarks—in facilitating access to finance for European startups. The Report looks at the connection between startups’ filing of intellectual property rights and their success in raising venture capital funds, as well as the role of patents and trademarks as predictors of successful exit strategies for investors.[1]

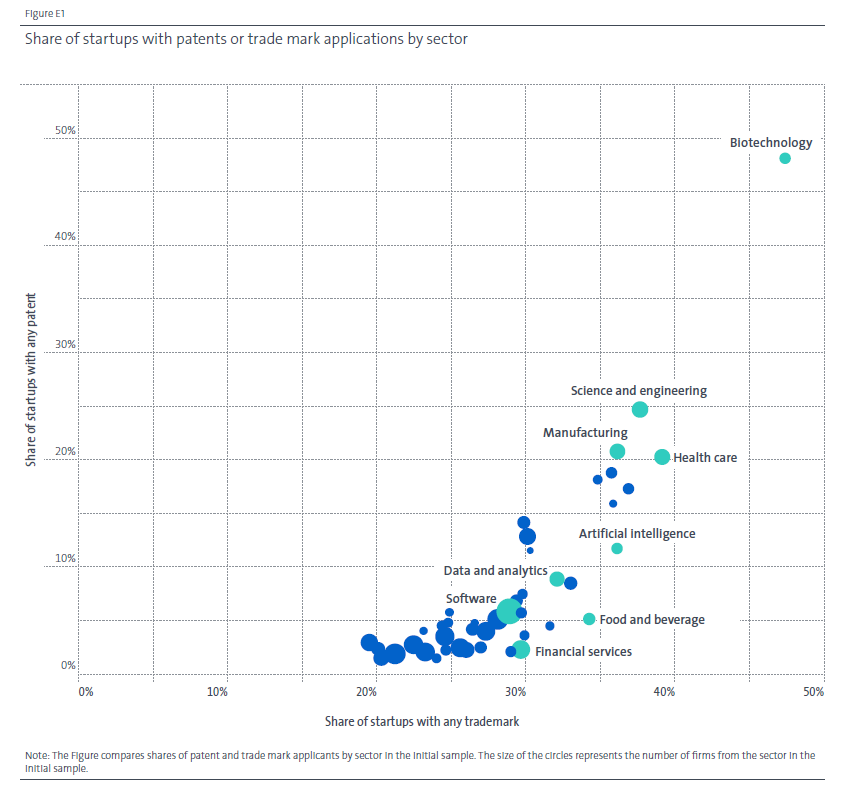

The Report found that on average, 29% of European startups have sought registered intellectual property rights, although there are notable variations across industry sectors. The biotechnology sector stands out as the most IP-intensive, with 65% of startups utilizing patents or registered trademarks. Other IP-intensive sectors include science and engineering (with 25% patent users and 38% trademark users), health care (20% patent users and 40% trademark users), and manufacturing (20% patent users and 36% trademark users).

Overall, the Report’s findings demonstrate that startups that choose to register their intellectual property rights have a significantly higher likelihood of securing early-stage financing than startups that do not (up to 10.2 times more likely to obtain subsequent VC funding).

Furthermore, these startups are more likely to yield a successful return on investment to their early investors through an initial public offering or a sale to another company. The filing of patent and/or trademark applications is associated with more than twice as high a likelihood of a successful exit for investors. The probability of obtaining financing and achieving a successful exit is even greater for startups that apply for European-level rights and those that combine patents and trademarks.

In a nutshell, the Report shows that startups that register IP rights send a clear signal to potential financiers that they have developed one or more valuable intellectual assets that are eligible for formal protection. A startup may have exclusive patent rights to an innovative product or may be manifesting its intent and ability to bring new products and services to the market through trademarks. These are perceived as indicators that the company intends to legally safeguard and capitalize on these assets in the marketplace.

In addition, the Report found that the relationship between the probability of access to funding and IP rights registration is even greater when a startup registers its rights at the European level. This communicates to investors that the startup plans to expand beyond its home country and enhance prospects for growth, making it more appealing to the venture capital community.

The Report closes with a recommendation to European policymakers: Because many of the startups in the study are working to decarbonize Europe with innovative solutions, policymakers should create an environment that encourages venture capital activity and makes IP protection an attractive proposition for startups. This can be achieved by establishing a robust IP system that covers the entire process, from registration to enforcement. By addressing this challenge, policymakers will support startup growth and success.

[1] The full Report is available here www.euipo.eu/startup-finance.